Fx Forward Pricing

Make sure the base currency is the denominator, and equal to 1, when determining the spot.

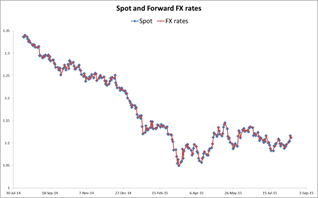

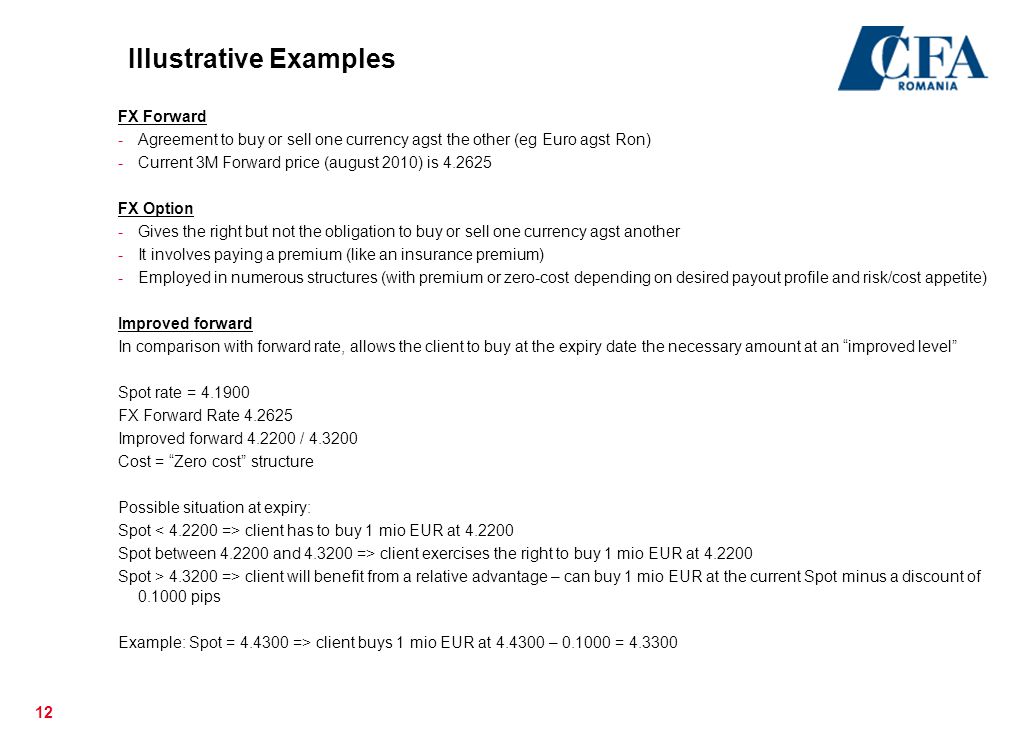

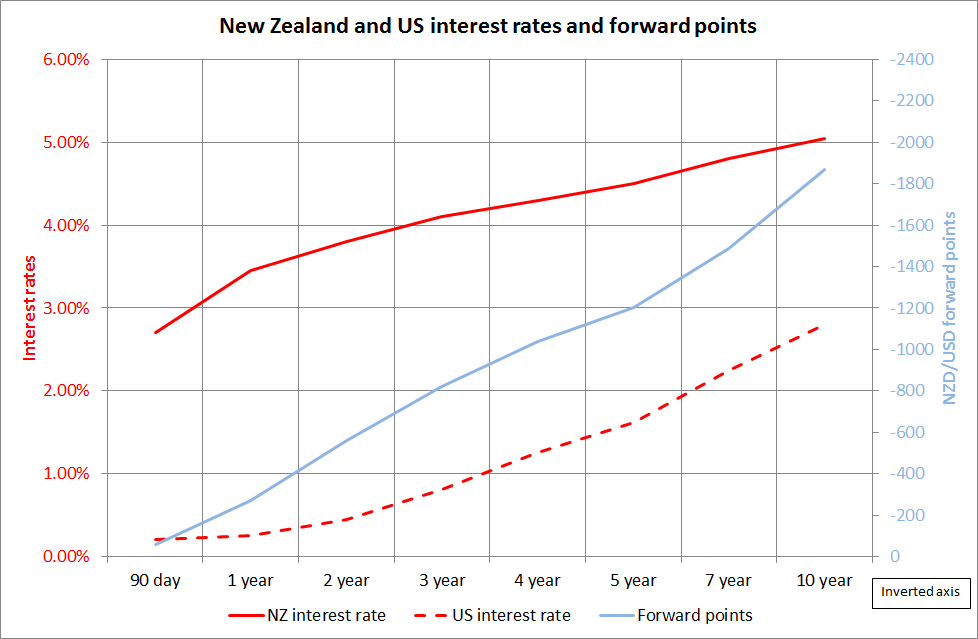

Fx forward pricing. In particular, higher interest rate currencies will trade at a forward discount to interest rates with lower interest rates. FX Forward pricing with correlation between FX and Zero-Cupon. FX Forwards and Pre-Spots:.

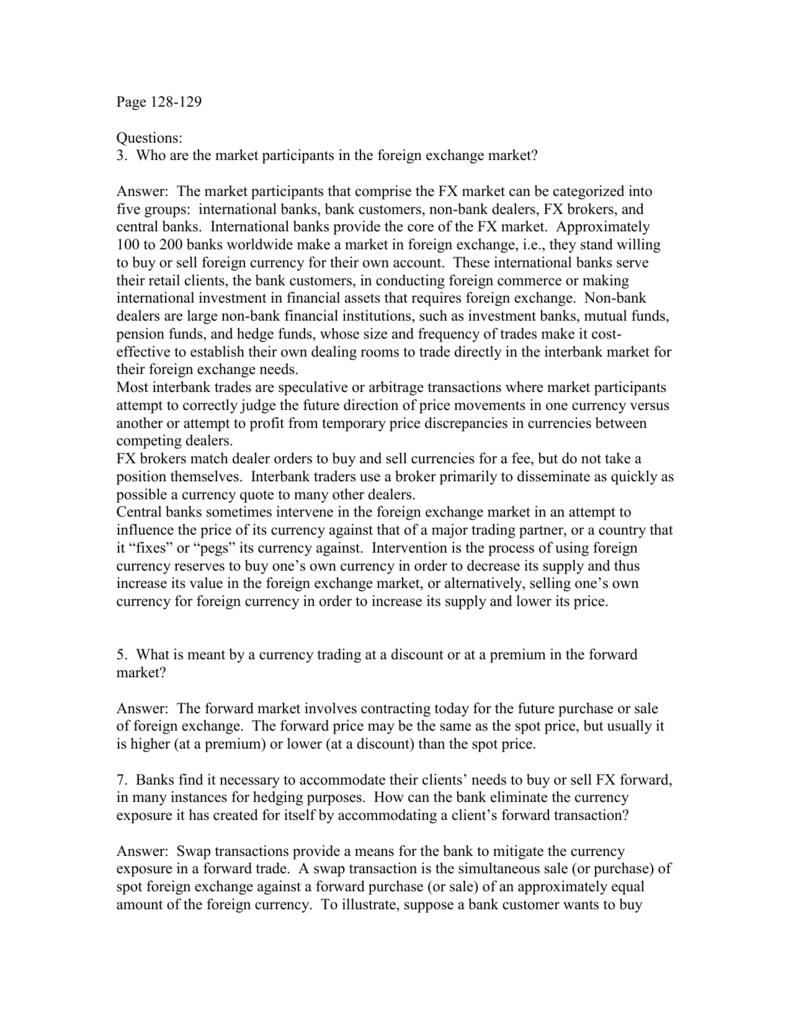

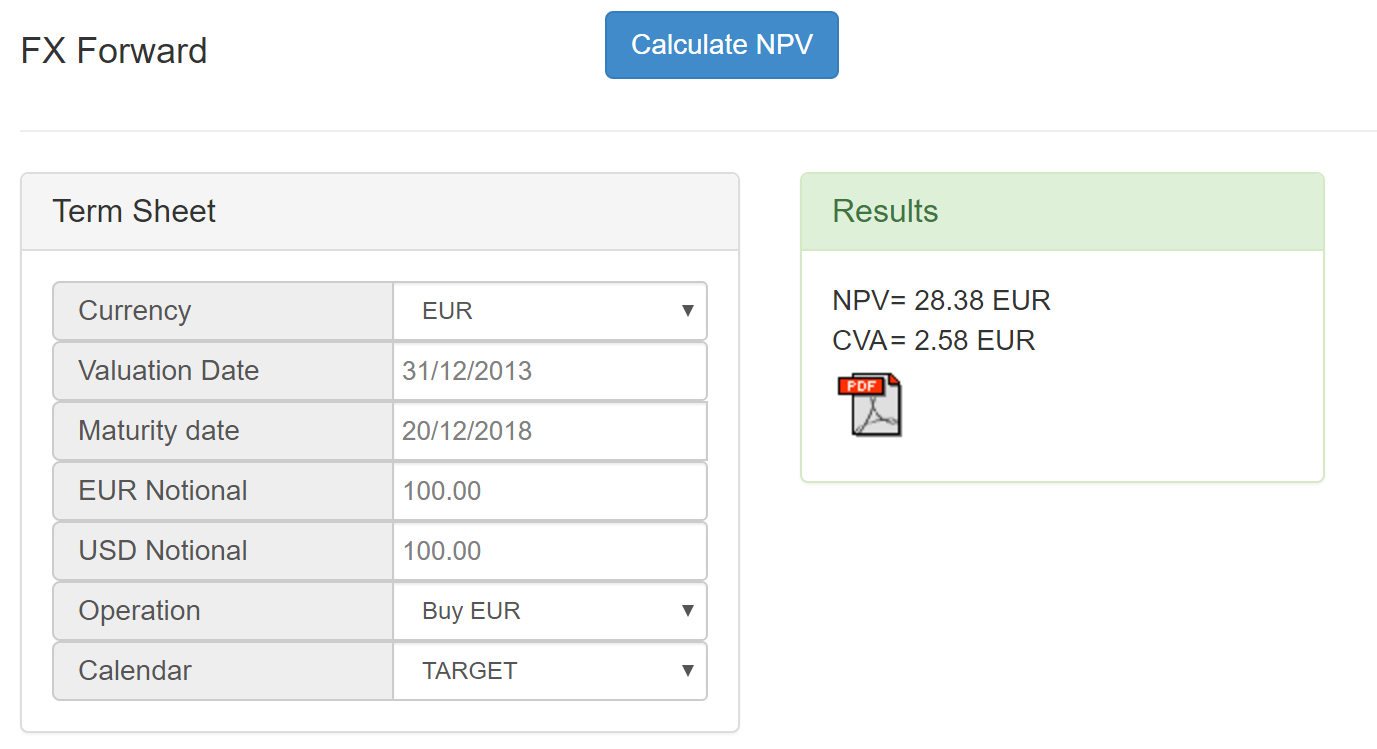

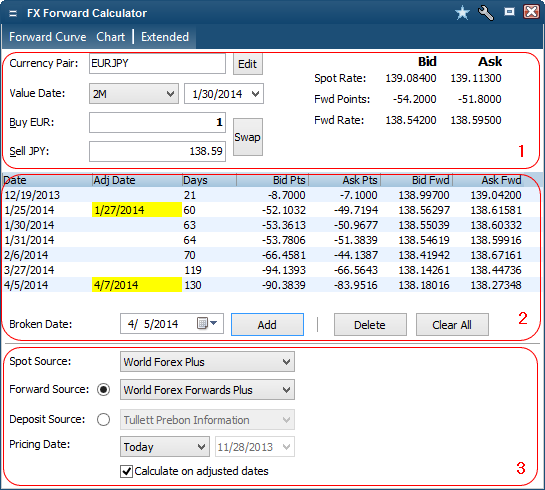

So if a dealer quotes you a forward price as 106 forward points, and the EUR/USD happens to be trading at 0.7400, then the forward price at that moment would be 0.7400 - 106 = 0.7294. To get credit risk adjusted valuation add this to NPV. Choose a tab to find out what’s driving FX rates, index trends or commodity pricing and click on any of the markets displayed.

Forward in dollars=spot+Forwardpoints/ , Forward in Euros=1/ForwardInDollars;. This is called a forward contract;. BBG did use a forward of 1. (forward points were quoted as -6.31).

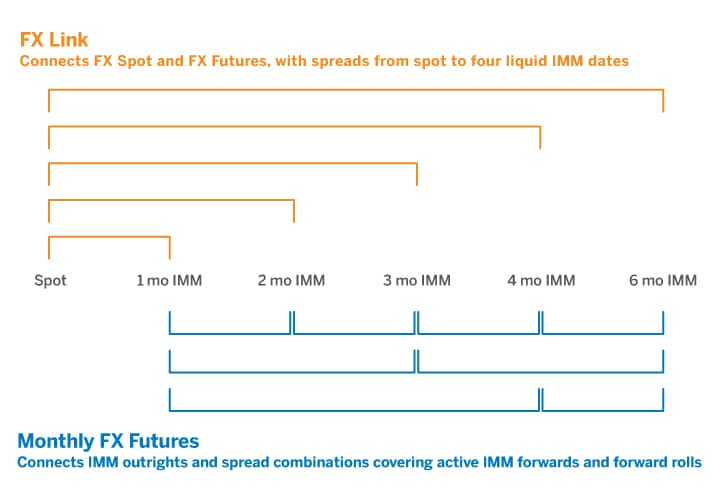

On June 9, 19, CME Group changed the expiration time on the last trading day of weekly, monthly, and quarterly expiries of the FX option contracts on the corresponding. FX Forward Settlement Dates. Active 4 years, 1 month ago.

Bank beating exchange rates. Using the example of the U.S. Pricing Futures and Forwards by Peter Ritchken 2 Peter Ritchken Forwards and Futures Prices 3 Forward Curves n Forward Prices are linked to Current Spot prices.

In both models, we make use of a Monte Carlo simulation model to simulate the path of the future spot exchange. Encompassing the FENICS division, FX Option pricing covers global currency pairs across ATM, Butterfly, and Risk Reversal strategies. � This principle is based on the notion that there should be no arbitrage opportunity between the FX spot market, FX forward market, and the term structure of interest rates in the two countries.

You’ll find a host of data on each market asset, including live. Banks have never really wanted to clarify FX forward pricing, often building in various risk adjustments and spreads, but when broken down it is a relatively simple calculation. CVA Credit Valuation Adjustement is calculated on individual basis.

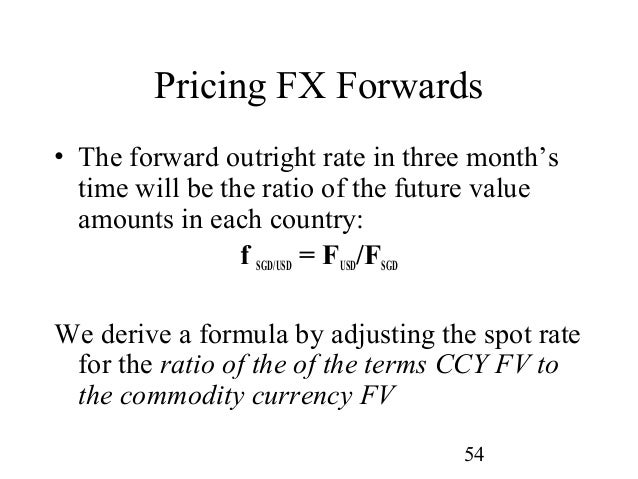

The "forward rate" or the price of an outright forward contract is based on the spot rate at the time the deal is booked, with an adjustment for "forward points" which represents the interest rate differential between the two currencies concerned. They have important differences, which changes their attractiveness to a specific FX market participant. The foreign exchange options market is the deepest, largest and.

N The forward price for delivery in a year may be further. How to do pricing of FX Swaps and Fx Forward in excel can anyone show the same which will match the bloomberg.I am calculating by adding or subtracting the fx fwd points in fx spot rate to arrive at forward if anyone have abything else please share the same. Forward price is the price at which a seller delivers an underlying asset, financial derivative, or currency to the buyer of a forward contract at a predetermined date.

FX forward with stochastic interest rates pricing. That is using the spot price or basis rate as reference forwards are quoted as the difference in pips between the outright price and the spot price for FX, or the difference in basis points between the forward rate and the basis rate for interest rate swaps and forward rate agreements. Forward Foreign Exchange.

The example serves to provide a “back of the envelope” guide to calculating fx forward points and outright rates. Shows US OIS as 0.815% and CAD implied as 0.269% $\endgroup$ – FinanceGuyThatCantCode Apr 11 '17 at 13:38 $\begingroup$ Why we are dividing P by X (strike price) can you explain it. Dollar and the Ethiopian Birr with a spot exchange rate of USD-.

Ins & Outs The Matrix:. Forward contracts, futures contracts, and options. A Diagram of Markets The Law of 1 Price:.

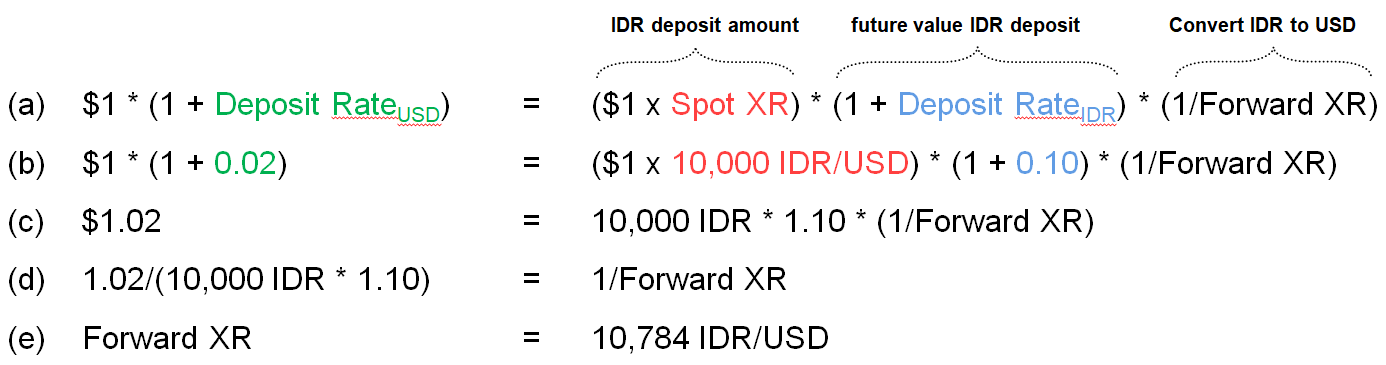

Viewed 640 times 6. FX forward rates, FX spot rates, and interest rates are interrelated by the interest rate parity (IRP) principle. FX Forward Pricing As well as providing direct access to liquidity providers for better than bank deliverable foreign exchange and same day money transfers currency broker clients can use a currency forward to lock in an exchange rate for up to a year in advance.

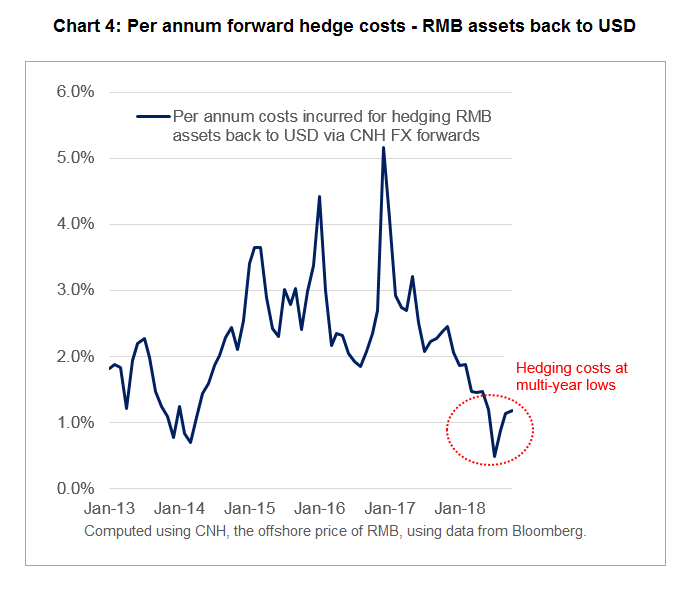

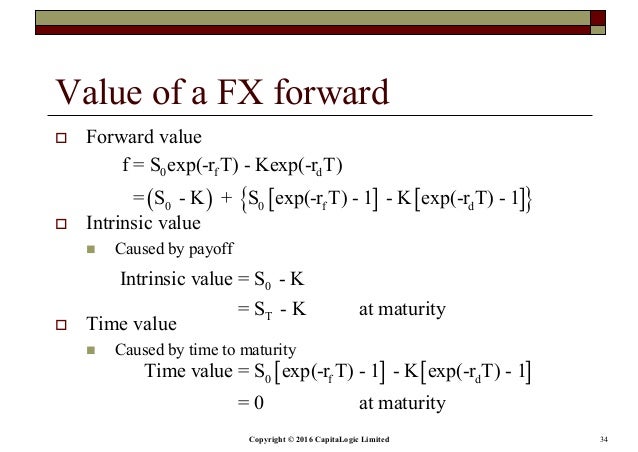

MICRO EVIDENCE FROM BANKS’ DOLLAR HEDGING* Puriya Abbassi Deutsche Bundesbank Falk Bräuning Federal Reserve Bank of Boston Abstract Using transaction-level data on foreign exchange (FX) forward contracts, we document large demand- driven heterogeneity in banks’ dollar hedging costs. $$ V_0 (T)=0 $$ $$ F_0 (T)=S_0 (1+r)^T $$ During the Life of the Contract. A currency forward or FX forward contract is an agreement that allows the buyer to lock in an exchange rate the day on which the agreement is signed for a transaction that will be completed later.

A description on how banks price FX Forwards. Why use a currency broker for your FX Forward Pricing?. 0 $\begingroup$ I would like to extend my question about about FX Forward rates in stochastic interest rate setup:.

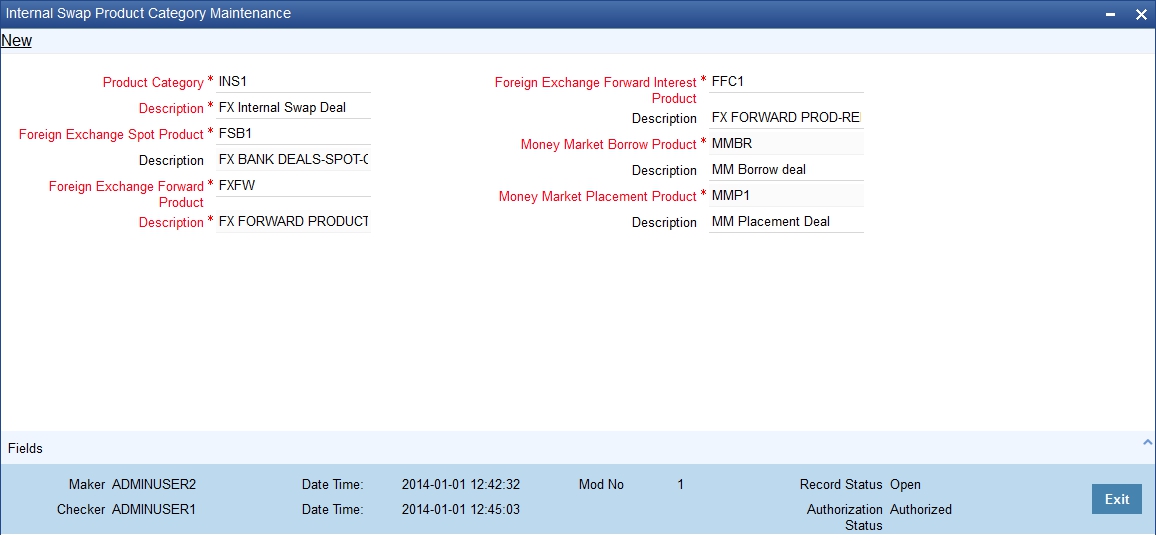

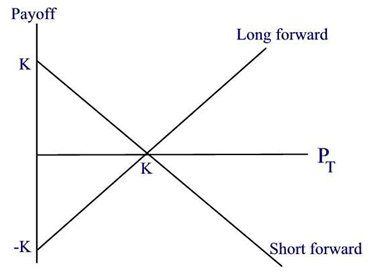

The FX and Money Markets service includes FX Forwards, NDFs, implied yields, cash deposits, and FRAs for a variety of currencies. K is the delivery price which is set in the contract. N Clearly, the forward price for delivery tomorrow should be close to todays spot price.

Caclulate net value of transaction at maturity:. Such contracts can be valuated using the well known cost-of-carry formula. The forward exchange rate is a type of forward price.

0.8067 – 0.25 = -0.0258 (or -258 fx points in the parlance of the fx markets). You simply subtract the forward points from whatever the spot price happens to be when you make your transaction. The three major types of foreign exchange (FX) derivatives:.

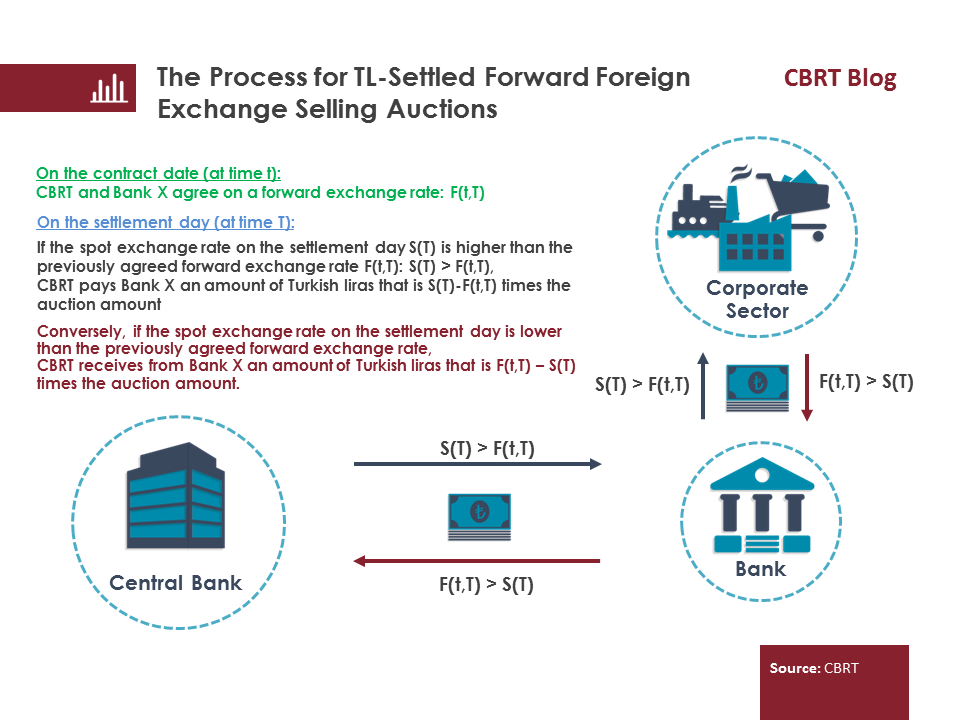

If forward points data available then forward valuation is based on syntetic USD curve which reproduces fx forwards. Manage FX exposure in our highly liquid marketplace using our cleared and listed futures and options, and award-winning FX Link. In finance, a non-deliverable forward (NDF) is an outright forward or futures contract in which counterparties settle the difference between the contracted NDF price or rate and the prevailing spot price or rate on an agreed notional amount.It is used in various markets such as foreign exchange and commodities.

A forward foreign exchange is a contract to purchase or sell a set amount of a foreign currency at a specified price for settlement at a predetermined future date (closed forward) or within a range of dates in the future (open forward). Calculate forward exchange rate in euros:. It is roughly equal to the.

N The forward price for immediate delivery is the spot price. NDFs are also known as forward contracts for differences (FCD). The pricing formula is similar to how FX forwards are priced in the OTC market.

Hot Network Questions What happens if a domestic flight lands in a foreign country due to an emergency?. It is the exchange rate negotiated today between a bank and a client upon entering into a forward contract agreeing to buy or sell some amount of foreign currency in the future. The price of an FX futures product is based on the currency pair’s spot rate and a short-term interest differential.

In finance, a foreign exchange swap, forex swap, or FX swap is a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates (normally spot to forward) and may use foreign exchange derivatives.An FX swap allows sums of a certain currency to be used to fund charges designated in another currency without acquiring foreign exchange risk. We consider a FX process. The cash payment is most often made using U.S.

In currency trading, forward points are the number of basis points added to or subtracted from the current spot rate of a currency pair to determine the forward rate for delivery on a specific. F = 30 – 28e-0.12×0.75 = 4.41. A currency forward is essentially a.

A combination of pricing and summing together the results of conventional derivative products (forwards & options) approach;. An FX swap agreement is a contract in which one party borrows one currency from, and simultaneously lends another to, the second party. Theory into Practice Overview Overview Introduction to Forward Rates Links Between Forex & Money Markets FX & MM Transactions:.

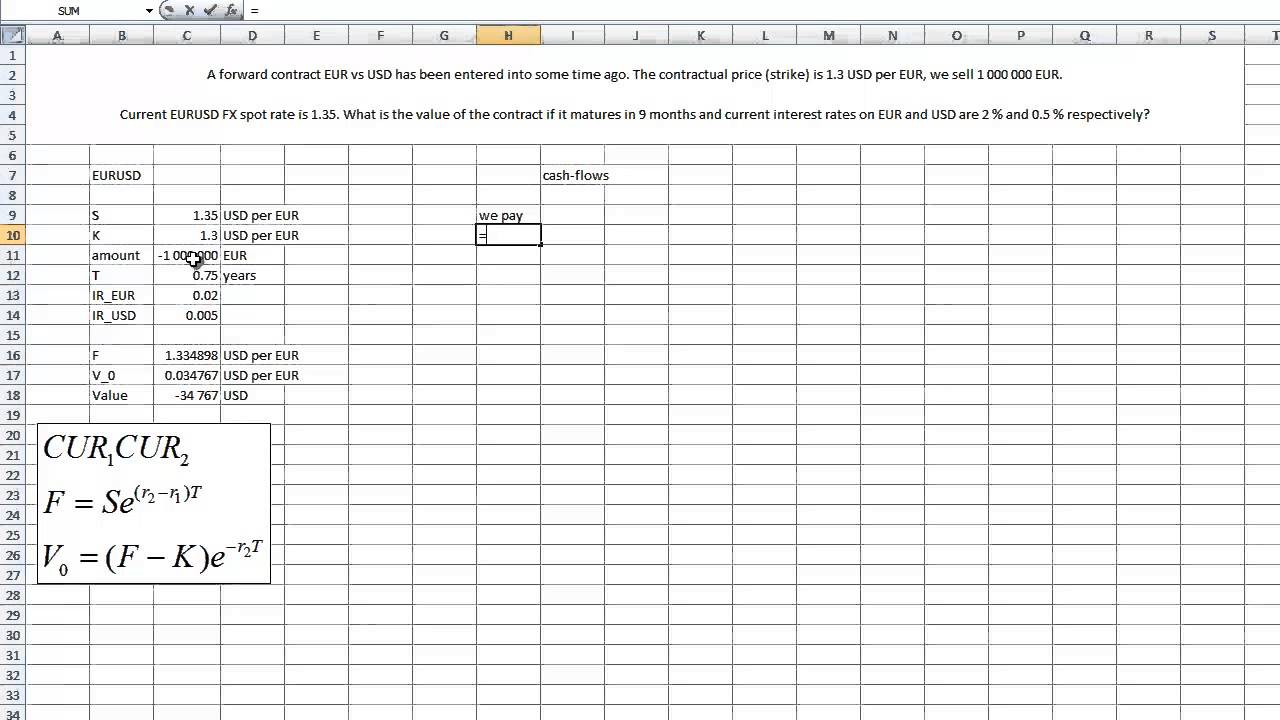

For example, if the spot price is 30, the remaining term to maturity is 9 months (0.75 years), the continuously compounded risk free rate is 12% and the delivery price is 28, then the value of the forward contract will be:. New York time at expiration, CME Group shall derive the CME FX fixing price (as a synthetic futures price) from quote vendor spot rates and appropriate maturity forward points. A forward premium is a situation in which the forward or expected future price for a currency is greater than the spot price.

Conversely, in markets with easily accessible spot prices or basis rates, in particular the Foreign exchange market and OIS market, forwards are usually quoted using premium points or forward points. Cumulative Integration with regard to Vasicek Model's Bond Price and its Forward Price. Get current price quote and chart data for any forward rate by clicking on the symbol name, or opening the "Links" column on the desired symbol.

A non-deliverable forward (NDF) is an FX exchange contract, where two parties agree to, on a date in the future, exchange currencies for the prevailing spot rate The difference between the NDF rate and the spot rate is the amount paid to the party who paid more of its own currency;. Ask Question Asked 4 years, 2 months ago. Forward price of a security with known cash income (Securities such as stocks paying known dividends or coupon bearing bonds).

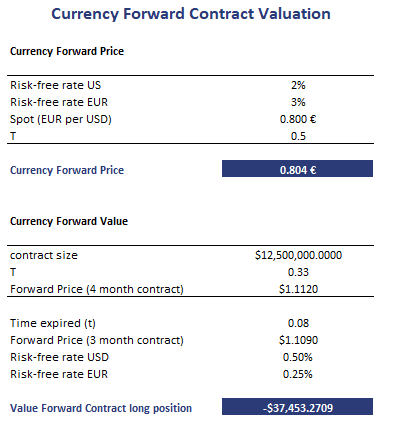

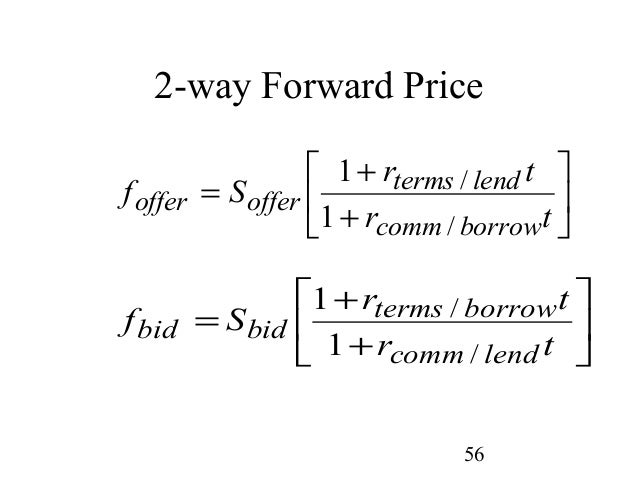

The pricing and valuation of currency forward contracts uses the covered interest rate parity to determine the no-arbitrage price. In bond markets, the forward rate refers to the effective yield. A forward rate is the settlement price of a transaction that will not take place until a predetermined date;.

Calculating the Forward Exchange Rate Step 1 Determine the spot price of the two currencies to be exchanged. Currency Forward Forward FX Rate Given spot rate 𝑋𝑠, spot date 𝑇𝑠 and forward date T, the FX forward rate can be represented as 𝑋𝑓=𝑋𝑠 𝐷𝑏(𝑇𝑠,𝑇) 𝐷𝑞(𝑇𝑠,𝑇) 𝑖𝑓𝑇≥𝑇𝑠 𝑋𝑓=𝑋𝑠 𝐷𝑞(𝑇,𝑇𝑠) 𝐷𝑏(𝑇,𝑇𝑠) 𝑖𝑓𝑇<𝑇𝑠 where. Collapse all expand all Key Findings.

The forward exchange rate is the rate at which a commercial bank is willing to commit to exchange one currency for another at some specified future date. Recently, I learned about open FX-forward contracts. Currency Forward and FX Forward Pricing and Valuation Practical Guide in FX Derivatives Trading Solution FinPricing.

In international finance, derivative instruments imply contracts based on which you can purchase or sell currency at a future date. 300+ currency pairs ( vs USD and cross currency) Forward Swaps. The bid/ask spread of the fx and interest rate markets accounts for the 12 fx point balance.

I am also looking at bloomberg syntax for fx fwd and fx swaps. Negative CVA means DVA i.e. Micro Evidence from Banks’ Dollar Hedging” and posted in November 18.

The Forex Forward Rates page contains links to all available forward rates for the selected currency. The value of the forward contract is the spot price of the underlying asset minus the present value of the forward price:. In finance, a foreign exchange option (commonly shortened to just FX option or currency option) is a derivative financial instrument that gives the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date.

THE PRICING OF FX FORWARD CONTRACTS:. FX forward valuation algorithm. Where S 0 is the spot price of the asset today T is the time to maturity (in years) r is the annual risk free rateof interest.

Forward Points, Bid Offer Price Formula, Market Quotes, and Uses - Duration:. $\endgroup$ – Amit Sep 30 '19 at 6:31. NetValue=Nominal*(Forward-Strike) discount it to valuation date with EUR discount curve:.

Else USD 3m curve is used to project EURUSD forward rate. Covered Interest Parity Arbitrage and the LOP Shopping around under CIP Infrequently asked Questions on CIP. So called closed FX-Forwards are well known forward contracts where some amount of foreign currency is bought at a specified date in the future for a price fixed "today".

� Formulas & Technical Details. A forward premium is frequently measured as the difference between the. Taking our data from one of the world’s leading intermediary brokers in the global foreign exchange market, Tullett Prebon Information is able to offer a comprehensive foreign exchange package reflective of real-time market observed rates traded in the wholesale market.

FX derivatives are contracts to buy …. This is a substantially revised version of the original paper, titled “The Pricing of FX Forward Contracts:. See Foreign exchange derivative.

This object is then fed into the formula in cell D1 that returns the price of 0, as it should, given the fact that our fx forward product in cell A1 has been constructed with a strike of 1.1396 that happens to match exactly the forward fx rate implied by the input interest rates in cells D9 and G10. FX forward example valuation:. The forward price at initiation is the spot price of the underlying compounded at the risk-free rate over the life of the contract.

Each party uses the repayment obligation to its counterparty as collateral and the amount of repayment is fixed at the FX forward rate as of the start of the contract. FX Forward pricing with correlation between FX and Zero-Cupon. The forward exchange rate is established through combining inflation expectations and the time value of money.

In the following equation, R is the short-term interest rate of a currency and d is the number of days from trade settlement until expiration. Benefit from open and transparent pricing to identify opportunities and find efficient alternatives to forwards, swaps, and options. A currency forward is a binding contract in the foreign exchange market that locks in the exchange rate for the purchase or sale of a currency on a future date.

No-arbitrage pricing in a rational world, means that the results from the two approaches should be the same. The risk inherent in a forward FX transaction is not market risk, it is delivery risk and that is why an FX partner will want to take a margin at the time the deal is.

Fx Forward Contract Valuation Youtube

Forward Fx

Spot Fx Forward Swaps Ndf S Live Fx Rates

Fx Forward Pricing のギャラリー

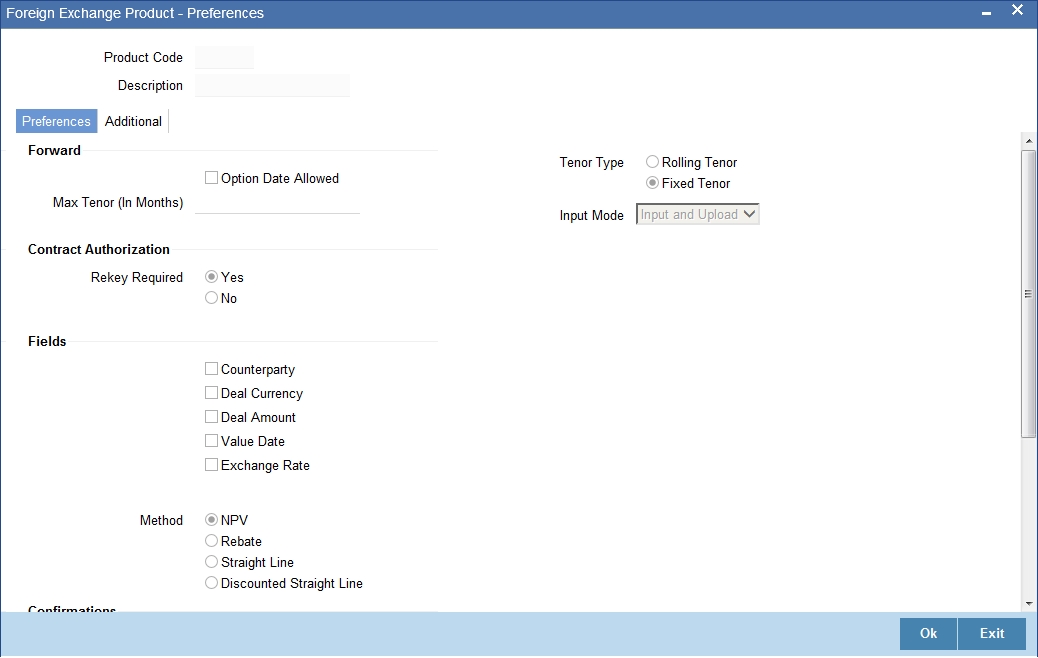

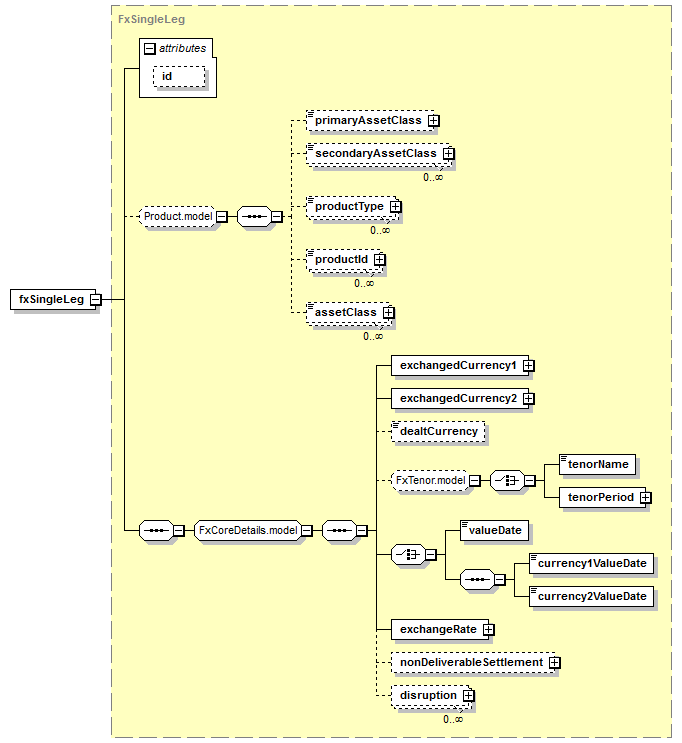

4 Defining Attributes Specific To Fx Products

Http Www Mysmu Edu Faculty Christophert Qf101 Qf101 Forswap Pdf

Forward Pricing Foreign Currency Cfa Tutor Youtube

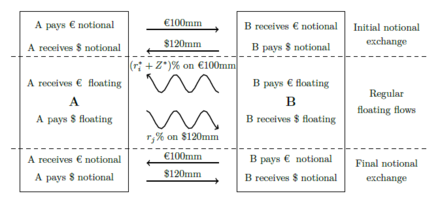

Currency Swap Wikipedia

What Is Forex Trading And How Does It Work

Ldi Newsletter Cross Currency Basis Institutional Blackrock

Forex Swap Margin Treatment Uncertain Ahead Of Vm Deadline Risk Net

1

Currency Derivatives A Practical Introduction

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

Currency Swap Basics

Replicating A Forward Exchange Rate Mark To Market Valuation Of Forward Contracts Risk Management In Banking

Q Tbn 3aand9gctc5lnx8ixo0mg10ezdlfk7exhcp4lpgoranymwfublfljgzbxp Usqp Cau

How To Calculate The Values Of Forward Rate Agreements Forward Foreign Exchange Rates Financetrainingcourse Com

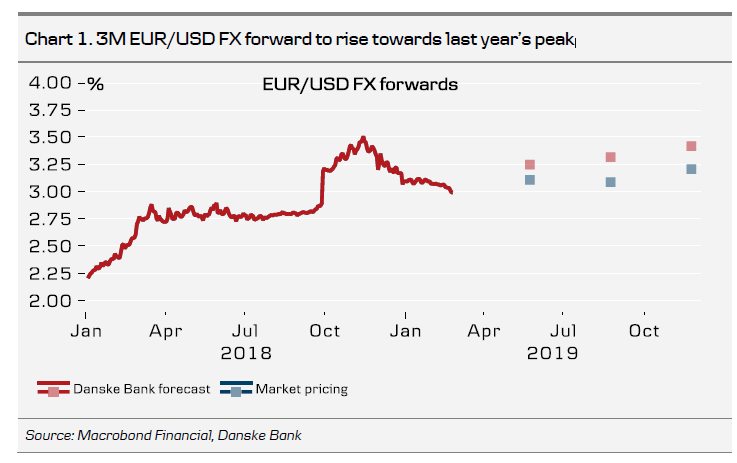

Fed Tightening To Push Eur Usd Fx Forwards Up Again Investing Com

Loomis Sayles Fx Trading Capabilities Strategies Solutions

3 Forward Contract Uses To Diversify Your Hedging Strategy Cambridge

Solution 5

Forward Premium Kantox

Financial Strategy Overview Bi Studocu

Hedging Foreign Exchange Risk Exposure By Importer Companies Science Publishing Group

Currency Forward Contracts Mfx Currency Risk Solutions

Do Currency Forwards Say Anything About The Future Value Of The U S Dollar Liberty Street Economics

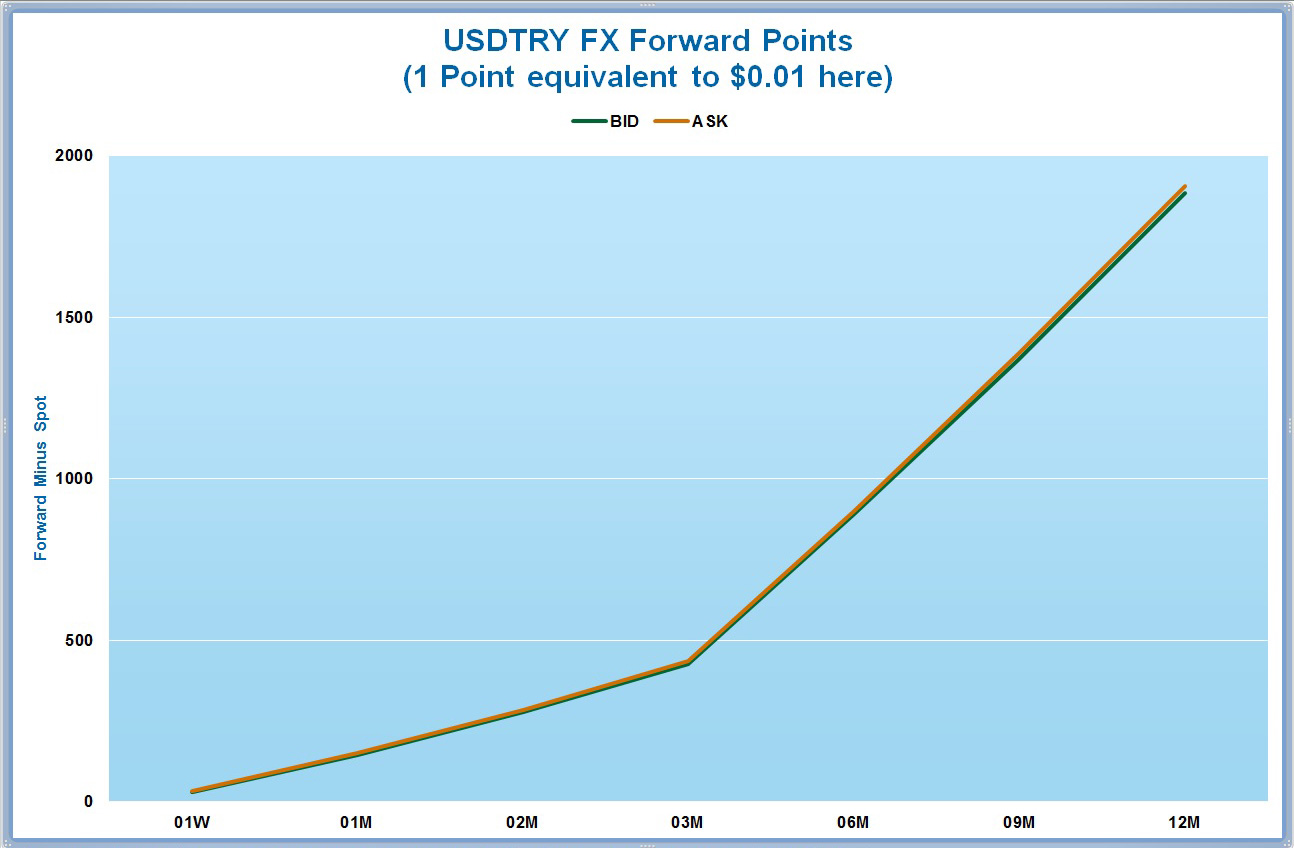

Fx Forward Points Spreads Data And Fx Yield Curve Construction Finpricing

Repository Upenn Edu Cgi Viewcontent Cgi Article 1096 Context Accounting Papers

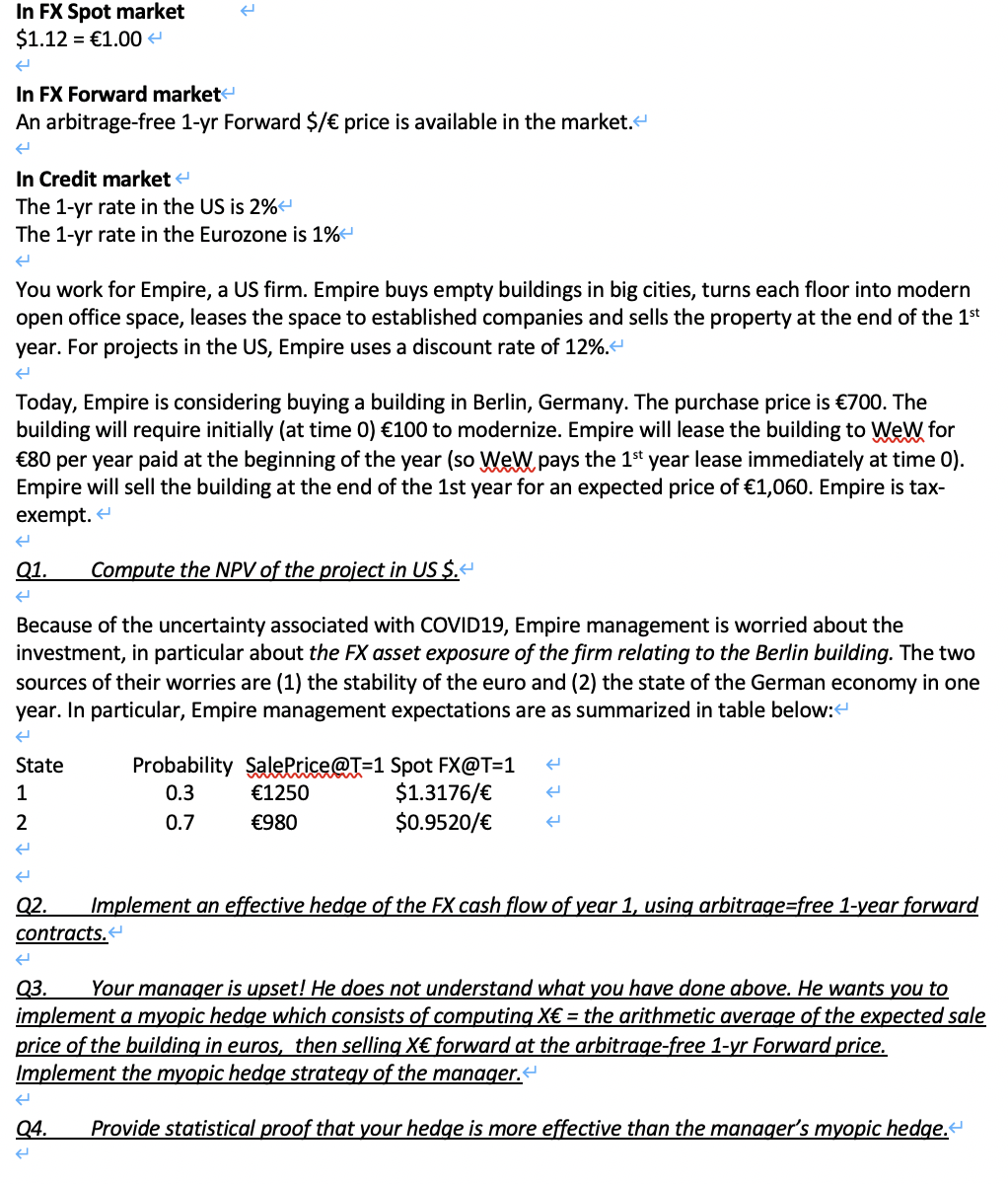

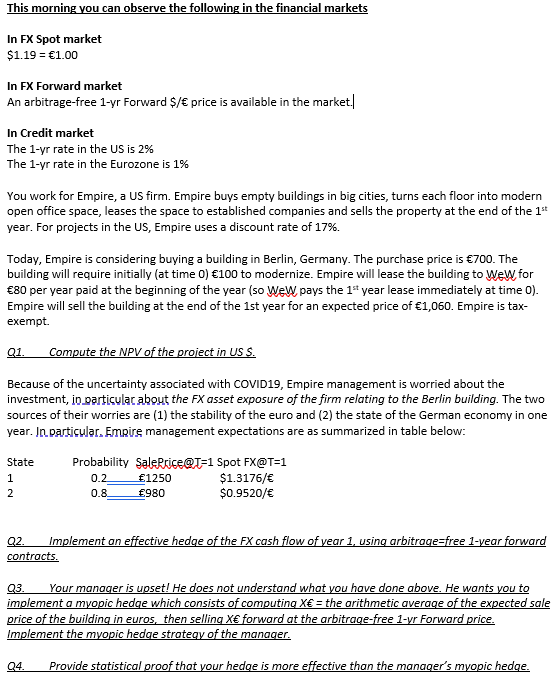

In Fx Spot Market 1 12 1 00 In Fx Forward Mark Chegg Com

Differences Between Swaps Forwards And Futures

Fx Spots Forwards Swaps And Curves In Excel Resources

2

Fx Risk Advisory Chinese Renminbi Approaches 7 00 Again Now What Silicon Valley Bank

Contango Wikipedia

1

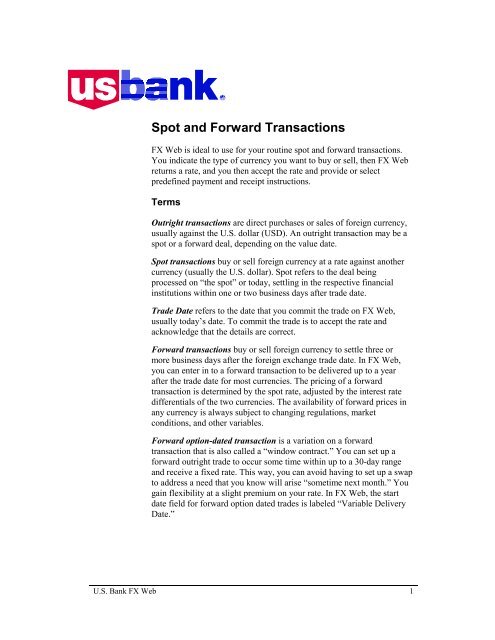

Spot And Forward Transactions

Guide To Managing Foreign Exchange Risk Toptal

Pdf Pricing Long Maturity Equity And Fx Derivatives With Stochastic Interest Rates And Stochastic Volatility

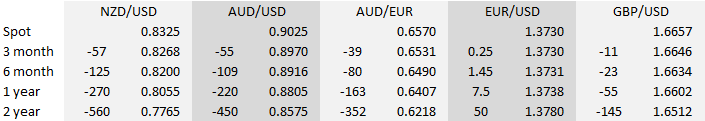

Calculating Fx Forward Points Hedgebook Pro

Fx Derivatives Terminology Education Module 5 Dated July Fx Derivatives Terminology Pdf Free Download

Fx Asian Option Pricing And Valuation Finpricing

4 Defining Attributes Specific To Fx Products

Fx Forward File Exchange Matlab Central

How To Value Fx Forward Pricing Example Pricederivatives Blog

Fx Markets David Whitcomb Cfa Trader Cargill Inc October 15 Th Ppt Download

What Is An Fx Forward Contract

Guide To Managing Foreign Exchange Risk Toptal

Spot And Forward Rate

Basics Of Fx Carry Seeking Alpha

Fx Forward Returns Basic Empirical Lessons Systemic Risk And Systematic Value

Introduction To Foreign Exchange Learn Fx Cfi

Forward Contracts Currency Hedging Strategies

Pdf Liquidity In Fx Spot And Forward Markets Semantic Scholar

Loomis Sayles Fx Trading Capabilities Strategies Solutions

Fx Spots Forwards Swaps And Curves In Excel Resources

Forex Swaps Example How You Can Make Money Online In 18

2

Merkezin Guncesi Turkiye Cumhuriyet Merkez Bankasi

Citi Bank

Http Www Microrate Com Media Docs Investment V Guide To Fx Fowards Pdf

Fx Spots Forwards Swaps And Curves In Excel Resources

Payoff On Forward Contracts

How To Calculate The Fx Forward Points For 3m Quantitative Finance Stack Exchange

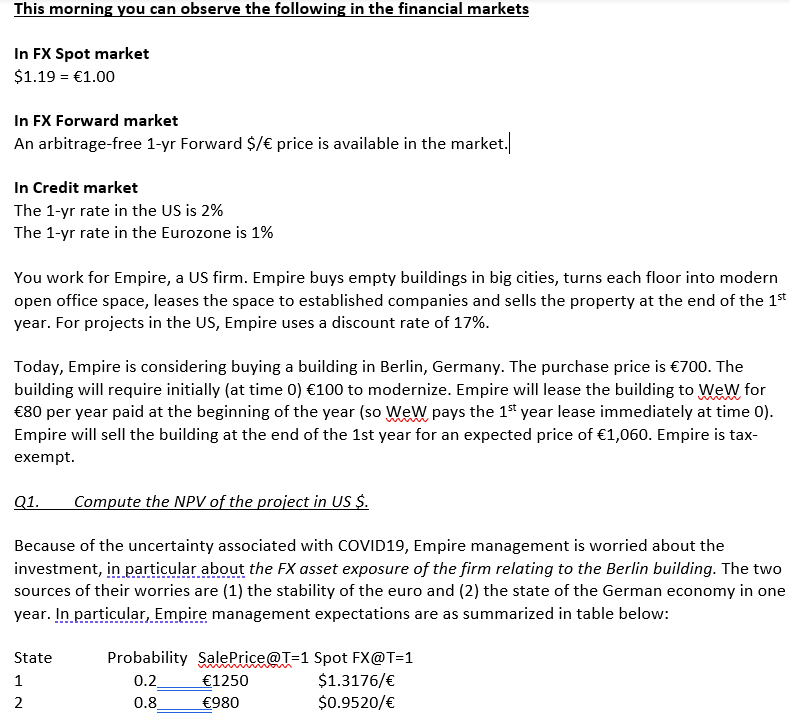

This Morning You Can Observe The Following In The Chegg Com

4 Defining Attributes Specific To Fx Products

Differences Between Swaps Forwards And Futures

Citi Bank

Replicating A Forward Exchange Rate Mark To Market Valuation Of Forward Contracts Risk Management In Banking

Fx Forward Rates Pricing Currencytransfer Com

Hedging Currency And Ir Risks Ppt Download

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

Currency Swap Basics

Currency Forward Valuation Breaking Down Finance

Downloads Course Source Net Vidmaitland Pdfs Advanced investments Fx contracts in geneva Pdf

Bu443 Lecture Notes Summer 19 Lecture 3 Foreign Exchange Risk Call Option Xu

2

1

Fx Monthlies

Www Bundesbank De Resource Blob 4efef6053fe8eba62d6bcd Ml 18 10 19 Dkp 42 Data Pdf

What Is Contango And Backwardation

2

Infront

Calculating Fx Forward Points Hedgebook Pro

Aoqu9ujg Stgom

Downloads Course Source Net Vidmaitland Pdfs Advanced investments Fx contracts in geneva Pdf

Chapter 5 Fx Forwards

What Does Taiwan S Hidden Forward Book Mean For Taiwan S Financial Stability And U S Currency Policy Council On Foreign Relations

Currency Derivatives A Practical Introduction

Www Econstor Eu Bitstream 6543 1 Pdf

Fx Spots Forwards Swaps And Curves In Excel Resources

Currency Forward And Fx Forward Pricing And Valuation Finpricing

Fx Forward Foreign Exchange Market Exchange Rate

1 Fx Forward Outrights

How To Calculate The Values Of Forward Rate Agreements Forward Foreign Exchange Rates Financetrainingcourse Com

Citi Bank

This Morning You Can Observe The Following In The Chegg Com

Fpml 5 6 Confirmation View Fx Product Architecture

Fx Market Spot Forwards And Swaps Billion Trader

Fx Spots Forwards Swaps And Curves In Excel Resources

Fx Time Option Forward Dbs Corporate Banking

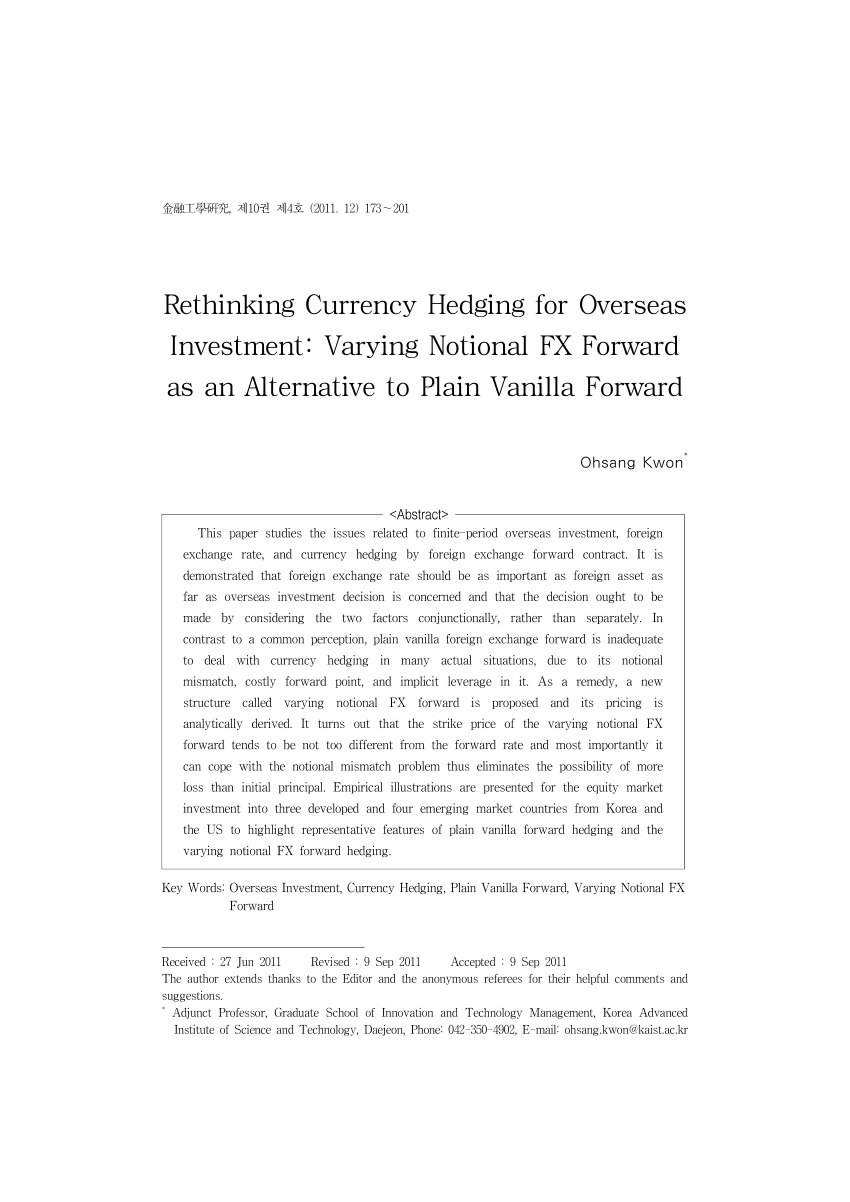

Pdf Rethinking Currency Hedging For Overseas Investment Varying Notional Fx Forward As An Alternative To Plain Vanilla Forward

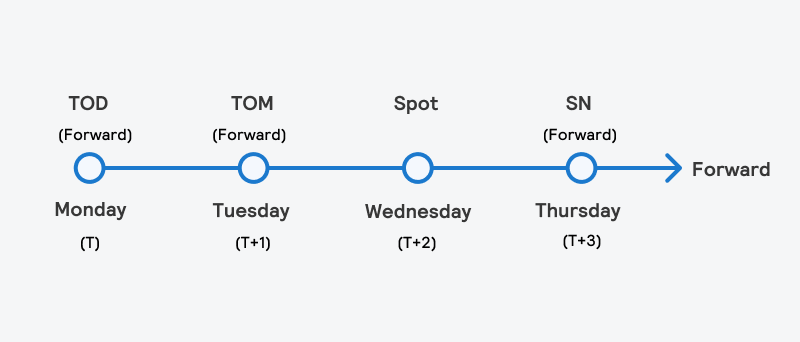

Just Value Dates In Fx The What Why And How

Manage Forward Contracts For International Payments American Express

Http Www Microrate Com Media Docs Investment V Guide To Fx Fowards Pdf

Mind The Gap How Interest Rate Changes Are Affecting Fx Forward Pricing Vuca Treasury

.png)

How To Hedge Currency Risk Foreign Exchange Hedging Explained Ig En